CMO (Chande Momentum Oscillator)

CMO (Chande Momentum Oscillator) is another momentum oscillator. It was developed by Tushar Chande, and, for the first time, it was introduced in the Technical Analysis of Stocks & Commodities magazine

in March 1992. Later, in 1994, Tushar Chande together with Stanley Krolland modified the indicator and presented it in their book titled The New Technical Trader.

As all other momentum oscillators, CMO helps monitoring an instrument's price momentum or, in other words, the speed at which the market price changes. It is worth doing as it is believed that momentum always

foreruns and influences price changes. The greater the momentum is, the faster an instrument's price changes; and the faster it changes, the stronger the price trend is.

The oscillator's values are calculated as a 100 times difference between the sum of source prices (for example Close) of N numbers of up periods (the periods that opened at higher prices

than the closing prices of the preceding periods) and the sum of source prices (Close) of N numbers of down periods (the periods that opened at lower prices than the

closing prices of the preceding periods) divided by the two sums total (the mathematical formula is provided later in the article).

On a chart, the values calculated for every period form a line oscillating between two (-100 and +100) levels. When the line goes up, an uptrend is present. Conversely, when the line goes down,

a downtrend is present. The line moving horizontally for a noticeable period of time (between -25 and +25) suggests a sideways market presence. The steeper the line is, the stronger the trend is.

When prices are persistently higher or lower than a certain level above or below the O line, an instrument is supposed to be overbought or oversold and a trend reversal can be expected. The values of

overbought and oversold levels are selected individually, but the most common ones are +50 and -50 respectively.

As all oscillators, CMO is always drawn in an additional area below the market price chart.

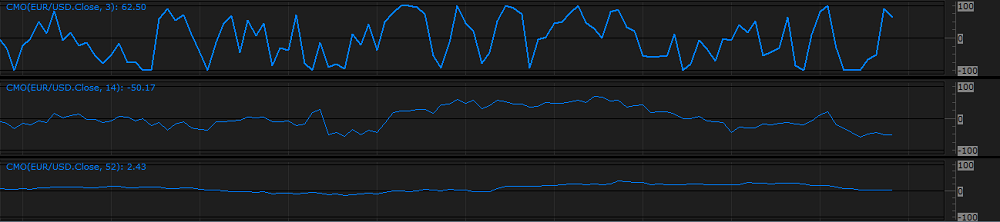

On the following picture, you can see an example of the CMO oscillator (with all its important level lines) drawn in an additional area below the market price chart.

Please remember that CMO oscillator uses the historical data for its calculation, and all the information it provides belongs to the past. Indicators do not predict the market price future behavior. A trader

can only suppose that the past tendencies will continue to develop in the same way for some time in the future and try to use this supposition appropriately.

As a momentum oscillator, CMO suits both ranging and trending markets, provided the trend takes on a zigzag format.

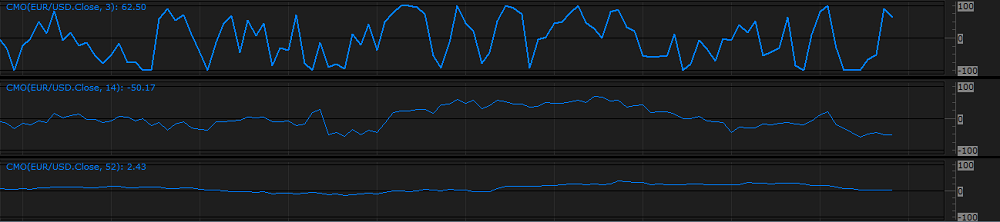

It is good to use the oscillator in conjunction with a market price chart and trend-following indicators that can confirm or deny its trading information. Adding one or two CMO charts with different

Number of periods parameter's values can also be a good idea to confirm the indicator's trading signals.

To apply a CMO oscillator to a chart, a trader needs to follow the procedure common to all Marketscope indicators. For more information, see the Add Indicator article.

During the procedure, a trader can customize an indicator by specifying its parameters in the Properties dialog box. For more information, see the Change Indicator Properties

article.

The parameters fall into two groups:

- Calculation - the parameters needed to calculate an indicator's prices.

- Style and Appearance - the parameters needed to specify the way an indicator appears on a chart.

The CMO oscillator has only one Calculation parameter - Number of periods. The parameter allows selecting the number of periods, over which the oscillator is to be calculated. The possible

values can be any. The default value is 14. The smaller the number is, the more sensitive the oscillator becomes. Its line has a greater amplitude and changes its direction more often. The greater the

number is, the less sensitive the oscillator becomes. Its line has a smaller amplitude and runs smoother. Traders choose the Number of periods parameter's value in accordance with their need of the

level of sensitivity of the oscillator. The recommended and most commonly used value is the default one - 14.

On the following picture, you can see examples of CMO oscillators with different Number of periods parameter's values (3, 14, and 52).

The parameter is available on the Parameters tab of the CMO Properties dialog box under the Calculation heading.

When a CMO oscillator is drawn on a chart, a trader can analyze its information and try to interpret it correctly. CMO produces several trading signals:

- Overbought and Oversold signals.

Because the CMO oscillator is range bound, it can also be useful for identifying whether an instrument is overbought or oversold. An instrument is overbought when CMO on its way up crosses the

reading of +50 and approaches the +100 line. It is oversold when the oscillator's line on its way down crosses the reading of -50 and approaches the -100 line. Note that by default the

lines on the levels of -50 and +50 are not drawn on the chart. For convenience, you can add horizontal lines on levels of your choice.

The scenarios produce the following trading signals:

- The CMO oscillator's line rising above the +50 reading can be a warning of a possible trend reversal downwards and the need to consider closing of Buy positions and opening

of Sell ones.

- The CMO oscillator's line dropping below the -50 can be a warning of a possible trend reversal upwards and the need to consider closing of Sell positions and opening of Buy ones.

On the following picture, you can see examples of the overbought and oversold signals.

Note: An instrument can stay overbought or oversold for a long period of time. Therefore, if CMO crosses the overbought or oversold level, do not undertake immediate actions until the

oscillator's line crosses the level in the opposite direction.

- Divergences

Divergences occur when the market prices and oscillator move in the opposite directions (divergence itself) or towards each other (often called convergence). It is a very strong signal of a possible

trend reversal. Divergences are further subdivided into the following two types:

- Bullish divergence occurs when an instrument's prices move down, but the CMO oscillator moves up or flat. This shows less downside momentum that can be treated as a warning of a bullish

reversal and the need to consider closing of Sell positions and opening of Buy ones.

On the following picture, you can see an example of a bullish divergence.

- Bearish divergence occurs when an instrument's prices move up, but the CMO oscillator moves down or flat. This shows less upward momentum that can be treated as a warning of a bearish

reversal and the need to consider closing of Buy positions and opening of Sell ones.

On the following picture, you can see an example of a bearish divergence.

Please note that divergences are often misleading in a strong price trend: a bullish (or bearish) divergence can occur in a strong downtrend (or uptrend) and yet the strong downtrend (or uptrend)

continues. Once a divergence takes hold, a trader should look for a confirmation of an actual reversal by other technical analysis tools.

The CMO oscillator's values are calculated automatically using the following formula:

CMOi = ((Su - Sd) / (Su + Sd)) x -100

where:

CMOi - is the CMO value of the period being calculated.

Su - is the sum of source prices (for example Close) of N numbers of up periods (the periods that opened at higher prices than the closing prices of the preceding periods).

Sd - is the sum of source prices (Close) of N numbers of down periods (the periods that opened at lower prices than the closing prices of the preceding periods).

back