TMACD (Triangular Moving Average Convergence/Divergence)

TMACD (Triangular Moving Average Convergence/Divergence) is a popular technical analysis indicator. As all the other moving average indicators, in its calculation, TMACD employs the technique of averaging the

price values of the periods, over which it is calculated.

In the result, TMACD produces a histogram reflecting the momentum of the market price trends. The histogram's values are calculated as the

difference between a shorter (in Marketscope called Short TMA) and longer TMA (in Marketscope called Long TMA). TMACD bars rise above and dive below the zero

line producing a momentum oscillator. Please note that TMA is a weighted moving average indicator that belongs to the trend-following group of indicators. In its calculation process, the indicator smooths its

values twice. The fact that TMA indicators are used for the TMACD indicator's calculation makes the histogram look smooth and, at the same time, serve as a trend-following indicator. Please also note that TMACD is always

drawn in an additional area below the market price chart.

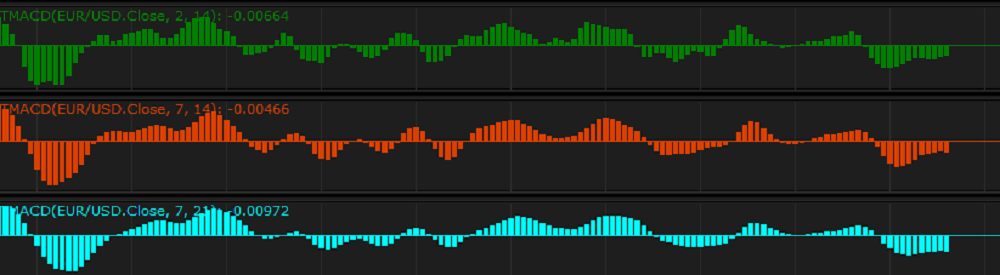

On the following picture you can see an example chart with the TMACD indicator in the lower additional area:

TMACD brings together momentum and trend in one indicator. Thus, it produces many trading signals (see later in the article). But on the other hand, the indicator often changes the direction of its histogram bars. On a chart, the bars often resemble frequent waves. These waves cause signals that can be false. Besides, the indicator's signals lag behind the market price changes significantly. Therefore, a trader needs to use caution while interpreting the signals and making trading decisions. The indicator is good on steady trends. When the market is volatile and the indicator produces frequent waves, it is better to refrain from active trading and wait till the market situation changes or use other technical analysis resources.

As an oscillator, TMACD is not particularly good for identifying overbought and oversold levels. Even though it is possible to identify levels that are historically overbought or oversold, the indicator has no any upper or lower limits to bind its movement. During sharp price moves, TMACD can exceed its historical extremes.

Besides, the TMACD indicator uses the historical data for its calculation, and, as a result, it reveals the market momentum and trend that have already developed and does not show the future ones. A trader can only suppose that the past events will continue to develop in accordance with his or her expectations for some time in the future and make appropriate trading decisions.

To apply a TMACD indicator to a chart, a trader needs to follow the procedure common to all Marketscope indicators. For more information, see the Add Indicator article.

During the procedure, a trader can customize an indicator by specifying its parameters in the Properties dialog box. For more information, see the Change Indicator Properties article.

The parameters fall into two groups:

- Calculation - the parameters needed to calculate an indicator's prices.

- Style and Appearance - the parameters needed to specify the way an indicator appears on a chart.

The TMACD indicator has two Calculation parameters - Short TMA and Long TMA. The parameters allow to specify the number of periods, over which the indicator's histogram is to be calculated.

The possible values are from 2 through 1,000. The default values are 7 for Short TMA and 14 for Long TMA. The smaller the number of periods of Short TMA or Long TMA is,

the more sensitive to the market price changes the histogram is. The most popular are the default values - 7 and 14.

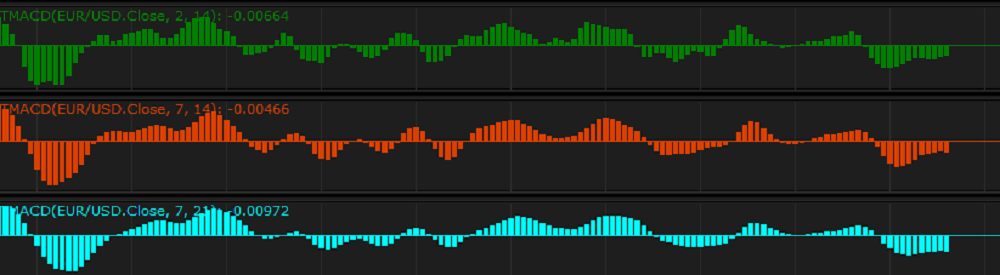

On the following picture, you can see that the TMACD (7, 14) histogram in the middle additional area below the chart is smoother and reacts to the price changes slower than the TMACD (2, 14) histogram in the upper additional area. On the other hand, it is less smooth and reacts to the price changes faster than the TMACD (7, 21) histogram in the bottom additional area. Please also note that the lagging of the indicator becomes greater with the greater number of periods used for calculation.

The parameters are available on the Parameters tab of the TMACD Properties dialog box under the Calculation heading.

When a TMACD indicator is drawn on a chart, a trader can analyze its behavior and try to predict the beginning of a new market trend or ending of an old one, in other words, determine trend reversal points that

can serve as trading signals. The two main ways of the TMACD indicator's interpretation are:

- The histogram appearance

It reflects the size of the difference between Short TMA and Long TMA, thus, indicating the strength of the market trend momentum. The greater the difference is, the taller the histogram bars

are, and, therefore, the greater the market trend momentum is. The histogram can be either positive or negative. It is positive when the difference between TMAs is positive. When the difference is

negative, the histogram is negative. Peaks, both positive and negative (easily determined visually), signify the possibility of trend reversals and the need to consider closing and opening of certain

positions: positive peaks suggest closing of Buy and opening of Sell positions, whereas, negative peaks suggest the opposite - closing of Sell and opening of Buy positions.

Crossing of the zero line by the histogram bars signals a trend reversal and the need to consider closing of Sell and opening of Buy (crossing from below) positions or closing of Buy

and opening of Sell (crossing from above) positions.

- Divergences

They happen when the market prices and the TMACD histogram imaginable outer line move in the opposite directions. The divergences can be of two types:

- Convergence - occurs when when the market prices and the TMACD histogram imaginable outer line move towards each other.

- Divergence - occurs when when the market prices and the TMACD histogram imaginable outer line move away from each other.

Convergences and divergences are not very frequent and can be determined visually.

Convergence warns of a possible reversal of the price downtrend and the need to consider closing of Sell and opening of Buy positions.

Divergence warns of a possible reversal of the price uptrend and the need to consider closing of Buy and opening of Sell positions. Please remember that making trading decisions requires caution

and employment of additional market analysis tools. The signals can be false due to frequent waves produced by the indicator and its substantial lagging behind the market prices. The longer the convergence or

divergence situations last, the more reliable the signals are.

On the following picture you can see instances of what was mentioned above. All the signals are good except for the Divergence signal (red) that is false as no trend reversal occurs.

The TMACD indicator values are calculated using the following formula:

TMACD = Short TMA - Long TMA

Note: For more information about the TMA indicator, see the TMA (Triangular Moving Average) article.

back