MAE (Moving Average Envelope)

MAE (Moving Average Envelope) is a trend-following indicator of the Marketscope standard indicators.

Moving Average Envelope helps to indentify an instrument's price trend presence and direction. For this purpose, the indicator calculates two values for every given period. The values are a certain percentage

above and below the MVA indicator's value of the same period.

On a chart, MAE is drawn as two parallel lines that envelope the market price bars. When the lines go up, an uptrend prevails. Conversely, when

the lines go down, a downtrend prevails. The price bars crossing over one of the lines warms of oversold or overbought conditions of the instrument and possible trend reversals. The lines' moving horizontally

for a noticeable period of time suggests a sideways market presence.

Note that the indicator can be drawn on the market price chart as well as in an additional area below it.

On the following picture, you can see an example of the MAE indicator drawn on the market price chart and in an additional area below it.

It is good to use the indicator in conjunction with the market price chart and trend-following indicators that can confirm or deny its trading information. Adding one or two MAE charts with different

Number of period's parameter values can also be a good idea to confirm the indicator's trading signals.

Please remember that the MAE indicator uses the historical data for its calculation, and all the information it provides belongs to the past. MAE does not predict the market price future behavior. A trader can

only suppose that the past tendencies will continue to develop in the same way for some time in the future and try to use this supposition appropriately.

To apply an MAE indicator to a chart, a trader needs to follow the procedure common to all Marketscope indicators. For more information, see the Add Indicator article.

During the procedure, a trader can customize an indicator by specifying its parameters in the Properties dialog box. For more information, see the Change Indicator Properties

article.

The parameters fall into two groups:

- Calculation - the parameters needed to calculate an indicator's prices.

- Style and Appearance - the parameters needed to specify the way an indicator appears on a chart.

MAE has three Calculation parameters:

- Number of periods - the parameter allows to specify the number of periods, over which the MAE values are to be calculated. The possible parameter's values are from 1 through 1,000. The default

value is 7. The smaller the number is, the more sensitive to the market price changes the MAE indicator is, and vice versa. The most popular is the default value - 7.

- Upper percentage value - the parameter allows to specify the percentage, by which the upper value of the indicator is to be shifted above the MVA indicator's value. The possible parameter's values are from 0 through 10.0. The default value is 0.5. The smaller the number is, the closer to each other the indicator's lines are, and vice versa. The most popular is the default value - 0.5

- Lower percentage value - the parameter allows to specify the percentage, by which the lower value of the indicator is to be shifted below the MVA indicator's value. The possible parameter's values are from 0 through 10.0. The default value is 0.5. The smaller the number is, the closer to each other the indicator's lines are, and vice versa. The most popular is the default value - 0.5

The parameters are available on the Parameters tab of the MAE Properties dialog box under the Calculation heading.

MAE has the following Style parameters:

- Top line color - the parameter is similar to the Line color parameter of all the other standard indicators of Marketscope. By default, the color is red.

- Top line width - the parameter is similar to the Line width parameter of all the other standard indicators of Marketscope. The default value is 1.

- Top line style - the parameter is similar to the Line style parameter of all the other standard indicators of Marketscope. The default value is Solid line.

- Bottom line color - the parameter is similar to the Line color parameter of all the other standard indicators of Marketscope. By default, the color is blue.

- Bottom line width - the parameter is similar to the Line width parameter of all the other standard indicators of Marketscope. The default value is 1.

- Bottom line style - the parameter is similar to the Line style parameter of all the other standard indicators of Marketscope. The default value is Solid line.

The parameters are available on the Parameters tab of the MAE Properties dialog box under the Style heading.

When an MAE indicator is drawn on a chart, a trader can analyze its information and make use of the following trading signals:

- Uptrend and Downtrend indication

- The oscillator's line indicates an Uptrend when it goes steadily upwards. It is advised to consider closing of Sell and opening of Buy positions.

- The oscillator's line indicates a Downtrend when it goes steadily downwards. It is advised to consider closing of Buy and opening of Sell positions.

Note that the oscillator's line indicates a Sideways market when it stays close to the Zero line for a noticeable period of time. It is advised to refrain from trading activities.

It is also advised to confirm or deny the MAE information with other indicators' trading signals.

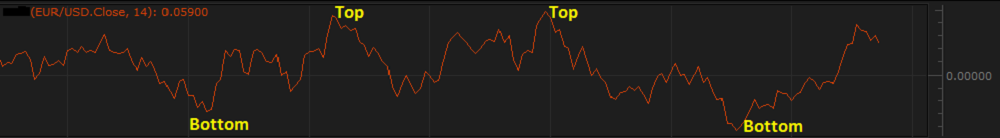

On the following picture, you can see examples of the MAE trading signals.

- Tops and Bottoms.

- The oscillator's line forms a Top when it rises to extreme values near the upper boarder of the chart. This is a warning of an instrument's being overbought and a possible trend reversal downwards.

It is advised to consider closing of Buy and opening of Sell positions.

- The oscillator's line forms a Bottom when it drops to extreme values near the lower boarder of the chart. This is a warning of an instrument's being oversold and a possible trend reversal upwards.

It is advised to consider closing of Sell and opening of Buy positions.

On the following picture, you can see examples of the Tops and Bottoms signals.

Note: Instruments can stay overbought or oversold for long periods of time. Therefore, if MAE reaches Tops or Bottoms, do not undertake immediate actions and wait till the line starts

moving in the opposite direction.

It is true that MAE reflects the market price direction with its Average line and volatility with its upper and lower Band lines. Prices are considered to be relatively high when they are above the

upper (Top) band line and relatively low when below the lower (Bottom) band line. Likewise, when prices continually touch the upper (Top) band line, they are thought to be overbought and, conversely, when they

continually touch the lower (Bottom) band line, the prices are thought to be oversold. However, to be treated as trading signals, these indications should be confirmed by some other technical analysis tools

before a trader decides to take a trading action.

The MAE indicator's values are calculated automatically using the following formulas:

AL = MVA

TL = AL + (SD x N)

BL = AL - (SD x N)

where:

AL - is the Average line value of the period being calculated.

MVA - is the MVA indicator's value of the period. The number of periods, over which it is to be calculated, is specified by the Number of periods parameter.

TL - is the Top band line value of the period being calculated.

SD - is the standard deviation value of the period being calculated. The number of periods, over which it is to be calculated, is specified by the Number of periods parameter.

N - is the number of standard deviations, over which the line is shifted above or below the Average line.

BL - is the Bottom band line value of the period being calculated.

back