FRACTAL (Fractal)

FRACTAL (Fractal) is one of five Bill Williams' indicators included in the list of standard indicators of Marketscope (the other four are ALLIGATOR (Alligator),

GATOR (Gator Oscillator), AC (Acceleration/Deceleration), and AO (Awesome Oscillator)). It was developed in 1995 and presented in Bill Williams' book

New Trading Dimensions.

FRACTAL is intended to help detecting a breakaway of a trend after a ranging market period. For this purpose, the indicator looks for fractals. A fractal is a certain pattern consisting of five

consecutive bars, the middle one of which has either the highest or lowest price value of all five. With the beginning of every new period, a new set of five bars (the new bar plus four immediately preceding

ones) is assessed whether it matches the pattern of a fractal or not. When a fractal pattern is detected, the middle bar is marked with an arrow above (when the middle bar has the highest price value) or

below it (when the middle bar has the lowest price value). An arrow above a bar warns of a trend breakaway downwards (a sell or bearish fractal). Conversely, an arrow below a bar warns of a trend breakaway

upwards (a buy or bullish fractal). Note that fractals can occur in sets that overlap each other, or it may take more than five consecutive bars till a fractal pattern is detected. Thus, the number of bars

between the ones marked with arrows can be any.

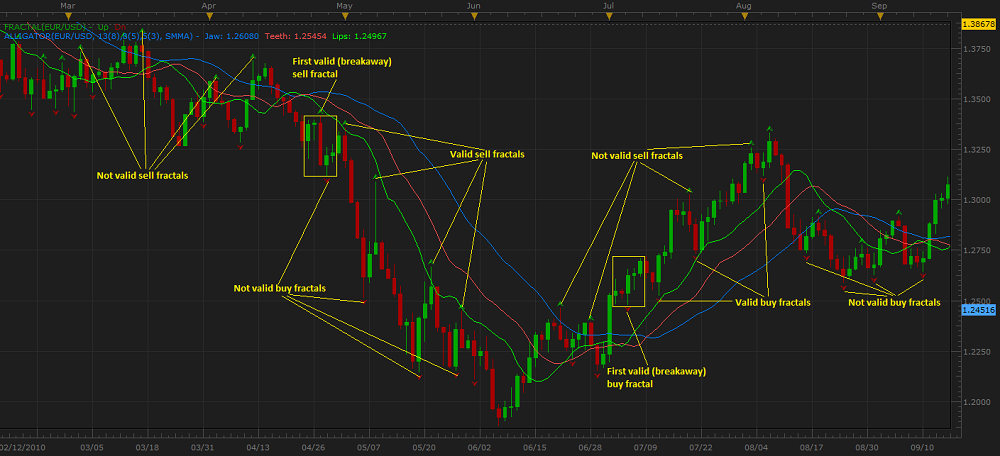

On the following picture you can see an example of the FRACTAL indicator drawn on the market price chart.

According to Bill Williams, the FRACTAL, ALLIGATOR, AC, and AO indicators form a complex trading system and work best when they are used in

conjunction with each other. As you can see, fractal patterns are encountered rather often. Many of them are not valid to signify a trend's breakaway. You need to filter them with the ALLIGATOR indicator to

locate true buy or sell FRACTAL signals. Valid FRACTAL signals are always out of the Alligator's mouth: buy fractals are always above, and sell fractals are always below the Teeth (red by default) line.

That's why FRACTAL is almost never used as a stand-alone indicator.

FRACTAL is a lagging indicator as its fractal pattern, the middle bar of which identifies a trend breakaway point, is detected two periods into the actual beginning of a price trend.

To apply a FRACTAL indicator to a chart, a trader needs to follow the procedure common to all Marketscope indicators. For more information, see the Add Indicator article.

During the procedure, a trader can customize the indicator by specifying its parameters in the Properties dialog box. For more information, see the Change Indicator

Properties article.

The specific FRACTAL parameters are listed on the Parameters tab of the Fractal Properties dialog box under the Style heading:

- Up fractal color - the parameter allows to specify the color of arrows above the middle bar of a fractal pattern. The default value is green.

- Down fractal color - the parameter allows to specify the color of arrows below the middle bar of a fractal pattern. The default value is red.

- Show fractal price - the parameter allows to show or hide the highest or lowest price of the middle bar. The prices appear next to all up and down arrows. The possible values are No

and Yes. The default value is No.

- Prices color - the parameter allows to specify the font color of the prices that appear next to the up and down arrows when the Yes value of the Show fractal price parameter is

selected. The default value is gray.

When a FRACTAL indicator is drawn on a chart, a trader can analyze its information and try to interpret it correctly. Please note that the fractal pattern matching process is not completed (though an arrow

can appear and disappear during the period) until the period is finished, and the following one begins. Therefore, make no trading decisions till the period ends. Trading decisions can be based on the latest

set of five complete bars only.

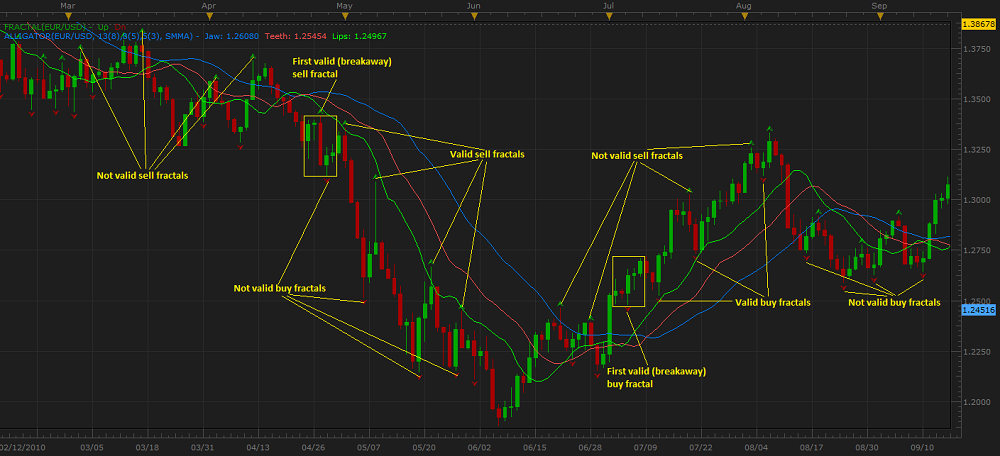

The indicator's signals mostly used to confirm the market price trend's beginnings and endings predicted by other technical analysis tools, such as the ALLIGATOR indicator. Please note that FRACTAL

is a very sensitive indicator and generates multiple signals (arrows). The level of sensitivity depends on the sizes of chart periods. The greater the size of a period is, the fewer signals the indicator

generates, and the more reliable they are. Placing of FRACTAL and ALLIGATOR indicators on one price chart allows to sort the multiple signals into useful (valid) ones and those that should be neglected.

The useful signals are the ones generated by the buy fractals with the arrows above the Alligator Teeth Line (red by default) or by the sell fractals with the arrows below the Alligator Teeth Line (red by

default). Consider opening or closing positions only when a valid (useful) fractal pattern is detected.

On the following picture you can see examples of breakaway, valid, and not valid fractals.

back